9th International Conference on Corporate Finance and Financial Markets

|

|

|

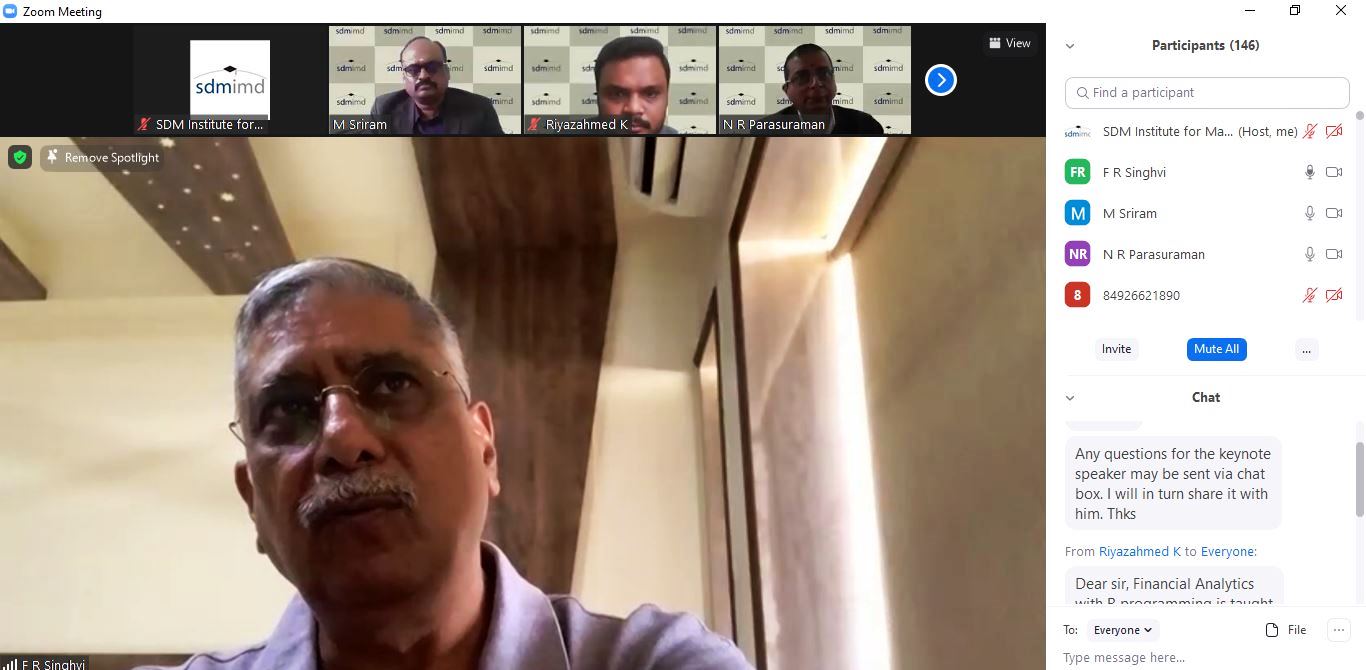

The 9th International Finance conference was held on 28th and 29th October,2021 at SDMIMD (virtual model). The conference was inaugurated by Sri.F.R.Singhvi, Joint Managing Director, Sansera Engineering Ltd Bengaluru who also delivered the keynote address. During the keynote address, he stressed on the importance of holding liquid assets for growth and sustenance of business. Liquidity ensures that businesses maintain adequate cash flows and are insulated from the vagaries of changes in macro-economic factors. He also touched upon how the automation process through AI (Artificial Intelligence) and ML (Machine Learning) is changing the landscape of the finance function and the business at large. Dr.N.R.Parasuraman, Director, SDMIMD released the conference proceedings in the form of a CD. During his speech, he highlighted the recent developments in the corporate finance and financial markets. Earlier, Dr.M.Sriram, Associate Professor-Finance, SDMIMD and the conference chair welcomed the gathering and introduced the conference theme for the year 2021.

Technical session delivered by Mr.Bharathram, Lokkur Finvestt Pvt Ltd, Bengaluru focused on the factors driving the capital market. He also briefed the audience on the various aspects which need to be looked into before making any investments. Mr.Jacob Thomas, Delivery Manager, TCS Ltd, Germany spoke on block chain and cryptocurrency. His talk covered the nuances of blockchain technology and its application in various aspects of management. There were about 50 research papers which were presented by participants from India and abroad.

The valedictory address was delivered by Ms.Rajni Thakur, Chief Economist, RBL Bank Ltd, Mumbai. She provided an outlook on the current state of the financial markets and discussed how the global pandemic has impacted the economies in large and the functioning of financial markets. She was emphatic that fundamentals of the economy have started to rebound and the same was reflected in the performance of the financial markets in India.

|